Posted by John Donovan 31 August 2023

Posted by John Donovan 31 August 2023

Well, aren’t we in for a treat!

It seems the world’s most environmentally-conscious buddies, our friendly neighbourhood oil giants like BP, Chevron, ExxonMobil, Shell, and TotalEnergies, are diving deep into the influencer market. Because when you think “innovation in renewable energy,” you naturally think: “Instagram and TikTok!”

AFP has sniffed out a trend where icons of video game walkthroughs, doggo videos, and #VacationGoals are suddenly pivoting to plug gas stations and fuel rewards cards. Because, let’s be honest, who wouldn’t want a behind-the-scenes look at your favourite influencer’s exhilarating journey to the pump?

Shell’s “Climate-Friendly” Strategy Under Fire: ClientEarth’s Claim to Proceed, Because Who Cares About the Planet?

Shell’s “Climate-Friendly” Strategy Under Fire: ClientEarth’s Claim to Proceed, Because Who Cares About the Planet?

Shell Offshore files plans to return to Alaska’s North Slope

Shell Offshore files plans to return to Alaska’s North Slope

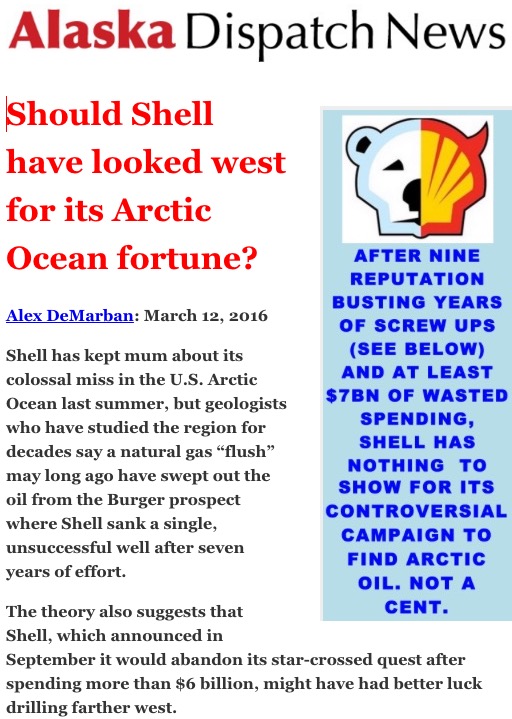

…these are also the same waters unsuccessfully explored by Royal Dutch Shell in 2015, after which the company halted Arctic operations for the foreseeable future.

…these are also the same waters unsuccessfully explored by Royal Dutch Shell in 2015, after which the company halted Arctic operations for the foreseeable future.

Credit: BSEE: By =&0=&2017-12-27 18:15:55

Credit: BSEE: By =&0=&2017-12-27 18:15:55

DECEMBER 27, 2017

DECEMBER 27, 2017 After Iran move, Total seen in pole position to snap up Qatar gas deals

After Iran move, Total seen in pole position to snap up Qatar gas deals

Terry Macalister

Terry Macalister

By

By

By

By

EBOOK TITLE: “SIR HENRI DETERDING AND THE NAZI HISTORY OF ROYAL DUTCH SHELL” – AVAILABLE ON AMAZON

EBOOK TITLE: “SIR HENRI DETERDING AND THE NAZI HISTORY OF ROYAL DUTCH SHELL” – AVAILABLE ON AMAZON EBOOK TITLE: “JOHN DONOVAN, SHELL’S NIGHTMARE: MY EPIC FEUD WITH THE UNSCRUPULOUS OIL GIANT ROYAL DUTCH SHELL” – AVAILABLE ON AMAZON.

EBOOK TITLE: “JOHN DONOVAN, SHELL’S NIGHTMARE: MY EPIC FEUD WITH THE UNSCRUPULOUS OIL GIANT ROYAL DUTCH SHELL” – AVAILABLE ON AMAZON. EBOOK TITLE: “TOXIC FACTS ABOUT SHELL REMOVED FROM WIKIPEDIA: HOW SHELL BECAME THE MOST HATED BRAND IN THE WORLD” – AVAILABLE ON AMAZON.

EBOOK TITLE: “TOXIC FACTS ABOUT SHELL REMOVED FROM WIKIPEDIA: HOW SHELL BECAME THE MOST HATED BRAND IN THE WORLD” – AVAILABLE ON AMAZON.