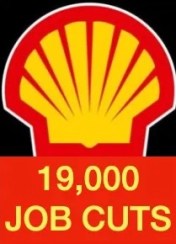

Shell’s Job Cutting Spree

Shell’s Job Cutting Spree

Posted by John Donovan: 18 Jan 24

In a move that’s less about saving the planet and more about saving pennies, Shell Plc has kicked off a spree of job cuts. And guess what? The low-carbon solutions unit is first in line! Because who needs a greener future when you can have a leaner payroll, right?

Sources spilling the beans to Bloomberg revealed that Shell is on a mission to ‘create more value through simplification and discipline.’ Translation: ‘Let’s chop jobs to boost our bottom line.’ The low-carbon business folks are getting their marching orders first, with the corporate affairs division and project and technology departments soon to join the unemployment queue.

Posted by John Donovan: 21 Dec 2023

Posted by John Donovan: 21 Dec 2023 Posted by John Donovan: 2 November 2023

Posted by John Donovan: 2 November 2023

Oil giant Royal Dutch Shell says it will take a £145m first-quarter hit from Texas freeze that left nearly 200 dead

Oil giant Royal Dutch Shell says it will take a £145m first-quarter hit from Texas freeze that left nearly 200 dead

Shell: What It Will Take To Be Investible Again

Shell: What It Will Take To Be Investible Again Shell Malaysia to cut 250-300 upstream jobs

Shell Malaysia to cut 250-300 upstream jobs

Oil giant Shell to axe 330 UK jobs due to covid restrictions – with thousands more to follow

Oil giant Shell to axe 330 UK jobs due to covid restrictions – with thousands more to follow

Royal Dutch Shell to cut more than 300 North Sea jobs

Royal Dutch Shell to cut more than 300 North Sea jobs

Translation of an article published by the Dutch financial newspaper, the FD.

Translation of an article published by the Dutch financial newspaper, the FD.  Bert van Dijk

Bert van Dijk EBOOK TITLE: “SIR HENRI DETERDING AND THE NAZI HISTORY OF ROYAL DUTCH SHELL” – AVAILABLE ON AMAZON

EBOOK TITLE: “SIR HENRI DETERDING AND THE NAZI HISTORY OF ROYAL DUTCH SHELL” – AVAILABLE ON AMAZON EBOOK TITLE: “JOHN DONOVAN, SHELL’S NIGHTMARE: MY EPIC FEUD WITH THE UNSCRUPULOUS OIL GIANT ROYAL DUTCH SHELL” – AVAILABLE ON AMAZON.

EBOOK TITLE: “JOHN DONOVAN, SHELL’S NIGHTMARE: MY EPIC FEUD WITH THE UNSCRUPULOUS OIL GIANT ROYAL DUTCH SHELL” – AVAILABLE ON AMAZON. EBOOK TITLE: “TOXIC FACTS ABOUT SHELL REMOVED FROM WIKIPEDIA: HOW SHELL BECAME THE MOST HATED BRAND IN THE WORLD” – AVAILABLE ON AMAZON.

EBOOK TITLE: “TOXIC FACTS ABOUT SHELL REMOVED FROM WIKIPEDIA: HOW SHELL BECAME THE MOST HATED BRAND IN THE WORLD” – AVAILABLE ON AMAZON.